In recent years, Decentralized Finance (DeFi), has emerged as a groundbreaking innovation in the financial sector. This revolution leverages blockchain technology to provide financial services in a decentralized, open, and permissionless manner. As traditional financial systems continue to evolve, DeFi presents both tremendous opportunities and significant risks. In this blog, we will delve into the core concepts of DeFi, explore notable DeFi projects, and discuss the risks and rewards associated with investing in this dynamic space.

Understanding Decentralized Finance (DeFi) and Its Applications

What is Decentralized Finance (DeFi) ?

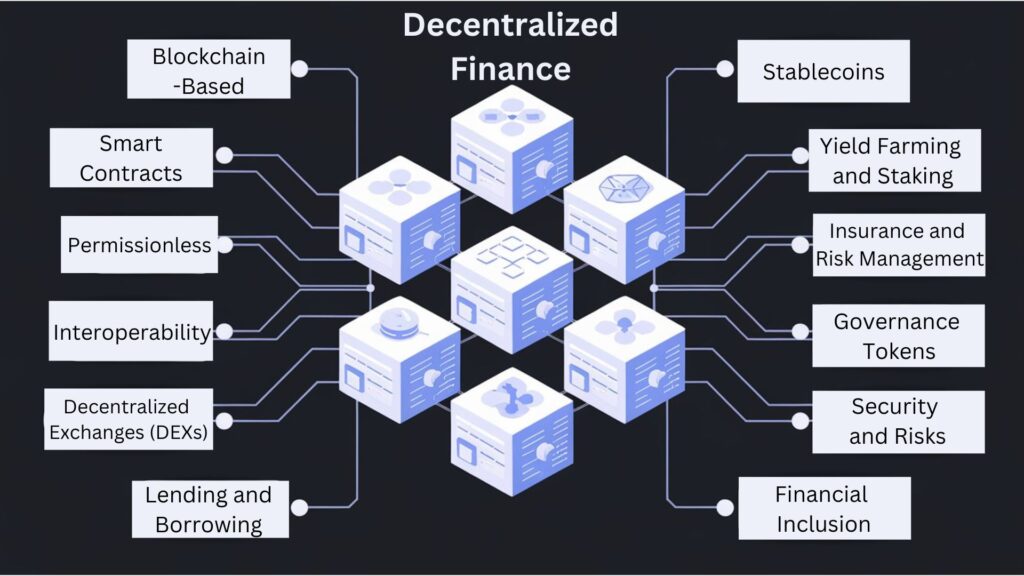

Decentralized Finance (DeFi) is a broad term that refers to financial services and products built on blockchain technology. Here are the key points:

- Blockchain-Based: Decentralized Finance platforms operate on blockchain networks, primarily Ethereum, but also other smart contract-enabled blockchains. This allows for transparent and immutable record-keeping.

- Smart Contracts: Decentralized Finance relies on smart contracts—self-executing contracts with the terms directly written into code. These automate and enforce transactions and agreements without intermediaries.

- Permissionless: Decentralized Finance services are open to anyone with an internet connection. There’s no need for a traditional bank account or to go through a financial institution to access financial services.

- Interoperability: Many Decentralized Finance projects are designed to work together. This means you can use one Decentralized Finance service in conjunction with others, creating a seamless financial ecosystem.

- Decentralized Exchanges (DEXs): Instead of relying on centralized exchanges, Decentralized Finance uses DEXs to facilitate trading of cryptocurrencies and tokens directly between users, reducing reliance on a middleman.

- Lending and Borrowing: Users can lend their crypto assets and earn interest or borrow assets using their crypto holdings as collateral. This process is managed through smart contracts.

- Stablecoins: Decentralized Finance often employs stablecoins, which are cryptocurrencies pegged to a stable asset like the US dollar, to minimize volatility and provide a more stable medium of exchange.

- Yield Farming and Staking: These are mechanisms by which users can earn rewards or interest on their crypto holdings. Yield farming involves providing liquidity to Decentralized Finance protocols, while staking involves locking up assets to support network operations or governance.

- Insurance and Risk Management: Some Decentralized Finance platforms offer decentralized insurance products, allowing users to protect themselves against risks in the crypto space.

- Governance Tokens: Many Decentralized Finance projects use governance tokens to give users a say in the protocol’s development and decision-making processes. Holders can vote on changes or proposals affecting the platform.

- Security and Risks: Decentralized Finance is relatively new and can be prone to vulnerabilities and risks such as smart contract bugs, security breaches, and regulatory uncertainties. Users should exercise caution and conduct thorough research.

- Financial Inclusion: By eliminating traditional intermediaries, DeFi aims to provide financial services to underserved or unbanked populations globally.

Overall,Decentralized Finance aims to recreate and enhance traditional financial systems using blockchain technology, offering more transparency, accessibility, and control to users.

Key Principles of Decentralized Finance

1 : Decentralization

DeFi platforms operate on decentralized networks, such as Ethereum, which eliminate the need for intermediaries. This decentralization is achieved through smart contracts and distributed ledger technology, which ensure transparency and trust without relying on a central authority.

2 : Open Access

DeFi projects are designed to be open to anyone with an internet connection. This inclusivity contrasts with traditional financial systems, which often have barriers to entry based on geography, income, or credit history.

3 : Interoperability

Many DeFi applications are built on interoperable platforms that allow them to work seamlessly with other DeFi projects. This creates a connected ecosystem where users can easily move assets and leverage multiple services.

4 : Programmability

Smart contracts enable the creation of programmable financial products that can automatically execute transactions based on predefined conditions. This programmability opens up new possibilities for creating complex financial instruments and services.

Applications of Decentralized Finance

DeFi encompasses a wide range of applications that aim to replicate or improve upon traditional financial services. Some of the most prominent applications include:

1 : Decentralized Exchanges (DEXs)

DEXs like Uniswap and SushiSwap allow users to trade cryptocurrencies directly with one another without the need for a central authority. These platforms use automated market makers (AMMs) to facilitate trades and provide liquidity.

2 : Lending and Borrowing

Platforms such as Aave and Compound enable users to lend and borrow cryptocurrencies without intermediaries. Lenders earn interest on their deposits, while borrowers can access funds by providing collateral.

3 : Stablecoins

Stablecoins like DAI and USDC are cryptocurrencies designed to maintain a stable value relative to a fiat currency. These assets are crucial for reducing volatility and facilitating transactions within the DeFi ecosystem.

4 : Yield Farming and Liquidity Mining

Yield farming involves providing liquidity to DeFi protocols in exchange for rewards, often in the form of additional tokens. Liquidity mining refers to the process of earning rewards for supplying liquidity to decentralized exchanges or lending platforms.

5: Insurance

DeFi insurance platforms, such as Nexus Mutual, offer coverage against smart contract failures, hacks, and other risks inherent in the DeFi space. These platforms use decentralized pools of capital to underwrite insurance policies.

Popular Decentralized Finance (DeFi) Projects to Watch

1 : Uniswap

Uniswap is one of the most well-known decentralized exchanges in the DeFi space. It operates on the Ethereum blockchain and uses an automated market maker (AMM) model to facilitate trades. Unlike traditional exchanges, Uniswap does not require an order book or matching engine. Instead, it relies on liquidity pools provided by users to enable trading.

Download – UNISWAP

2. Aave

Aave is a decentralized lending and borrowing platform that allows users to deposit cryptocurrencies and earn interest or borrow assets by providing collateral. Aave’s innovative features include flash loans—unsecured loans that must be repaid within a single transaction block—and the ability to switch between stable and variable interest rates.

Download – AAVE

3. Compound

Compound is another leading DeFi lending protocol that allows users to earn interest on their crypto holdings or borrow assets by providing collateral. Compound operates through a system of interest rate algorithms that adjust rates based on supply and demand.

Download – COMPOUND

4. MakerDAO

MakerDAO is the creator of DAI, a decentralized stablecoin pegged to the US dollar. The MakerDAO ecosystem includes the Maker protocol, which allows users to collateralize their assets to generate DAI, and the MKR token, which governs the protocol and helps maintain the stability of DAI.

Download – MAKERDAO

5. Yearn.Finance

Yearn.Finance is a yield optimization platform that automates the process of yield farming for users. By using various DeFi strategies, Yearn.Finance aims to maximize returns on deposited assets. The platform’s native token, YFI, is used for governance and incentivizing participation.

Download – YEARN.FINANCE

Risks and Rewards of Decentralized Finance (DeFi) Investing

Rewards of Decentralized Finance (DeFi) Investing

- High Returns: DeFi platforms often offer higher interest rates and yield farming opportunities compared to traditional financial products. This potential for higher returns attracts investors seeking to maximize their earnings.

- Accessibility: DeFi removes barriers to entry, allowing individuals from around the world to participate in financial activities. This inclusivity can provide access to financial services for those underserved by traditional institutions.

- Innovation and Flexibility: DeFi is a rapidly evolving space with constant innovation. Investors have the opportunity to participate in cutting-edge financial products and services, benefiting from new technologies and solutions.

- Transparency and Control: DeFi projects are built on blockchain technology, which provides transparency and traceability of transactions. Users maintain control over their assets and can interact directly with the protocol without intermediaries.

Risks of Decentralized Finance (DeFi) Investing

- Smart Contract Vulnerabilities: Smart contracts are susceptible to bugs and vulnerabilities that can lead to financial losses. Bugs or exploits in the code can be exploited by malicious actors, leading to potential losses for users.

- Regulatory Uncertainty: DeFi operates in a regulatory gray area, with governments and regulatory bodies still determining how to approach this new financial paradigm. Regulatory changes could impact the legality and functionality of DeFi projects.

- Liquidity Risks: While DeFi offers opportunities for high returns, some projects may suffer from low liquidity or insufficient market depth. This can result in slippage, where the value of a trade deviates from the expected price.

- Market Volatility: The cryptocurrency market is known for its high volatility, which can affect the value of DeFi assets and investments. Price swings can impact the value of collateral and the stability of DeFi products.

- Smart Contract Risks: DeFi projects rely on smart contracts, which are immutable once deployed. If a vulnerability is discovered after deployment, it can be challenging to fix without affecting the entire protocol.

Balancing Risks and Rewards

Investing in Decentralized Finance requires a careful assessment of both the potential rewards and the inherent risks. Diversification is one strategy to mitigate risk, as spreading investments across various Decentralized Finance projects and platforms can help balance potential losses. Additionally, conducting thorough research and staying informed about the latest developments in the DeFi space can aid in making informed investment decisions.

Conclusion

Decentralized Finance (DeFi) represents a significant shift in the financial landscape, offering new opportunities for innovation, accessibility, and efficiency. By understanding the core principles of Decentralized Finance, exploring notable projects, and evaluating the associated risks and rewards, investors and users can better navigate this evolving space. While DeFi holds promise for transforming traditional financial systems, it is essential to approach this frontier with caution and diligence, recognizing both its potential and its challenges. As DeFi continues to develop, staying informed and adaptable will be crucial for making the most of its opportunities while managing its risks effectively.

2 Comments

Cryptocurrency Mining: A Complete Guide to Understanding, Starting, and Navigating the Environmental Impact - bitbonix.com · December 11, 2024 at 5:05 am

[…] Absolute Knowledge about Decentralized Finance (DeFi) and Its Applications, and Key Considerations […]

Cryptocurrency Regulation and Legal Issues - bitbonix.com · December 12, 2024 at 8:38 am

[…] Absolute Knowledge about Decentralized Finance (DeFi) and Its Applications, and Key Considerations […]