Cryptocurrency trading has rapidly emerged as one of the most talked-about topics in the world of finance. With the meteoric rise of Bitcoin and other digital currencies, the potential to earn significant profits through cryptocurrency trading has attracted both seasoned investors and newcomers alike. But what exactly is cryptocurrency trading, and how can you navigate this complex yet rewarding landscape? In this comprehensive guide, we’ll delve into the essentials of cryptocurrency trading, providing you with the knowledge and tools you need to succeed.

What is Cryptocurrency Trading?

At its core, cryptocurrency trading refers to the buying, selling, and exchanging of digital assets on various online platforms known as cryptocurrency exchanges. Unlike traditional stock markets, which are open during regular business hours, crypto trading operates 24/7, offering traders unparalleled flexibility.

Cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, are decentralized digital currencies that utilize blockchain technology to ensure security, transparency, and immutability of transactions. This decentralized nature means that cryptocurrencies are not controlled by any central authority, making them immune to government interference and manipulation.

Cryptocurrency Trading is So Popular WHY????

The popularity of cryptocurrency trading can be attributed to several key factors:

- High Volatility: Cryptocurrency markets are known for their high volatility, meaning that prices can fluctuate significantly within a short period. This volatility creates opportunities for traders to profit from rapid price movements, whether through day trading, swing trading, or long-term investing.

- Accessibility: Unlike traditional financial markets, which often require significant capital and regulatory approval to participate, crypto trading is accessible to anyone with an internet connection and a small amount of capital. This democratization of trading has opened up new avenues for individuals to grow their wealth.

- 24/7 Market: The round-the-clock nature of cryptocurrency trading allows traders to capitalize on market opportunities at any time of day or night, regardless of their geographical location. This continuous market operation is a significant advantage for those who cannot trade during regular stock market hours.

- Diversification: Cryptocurrency trading offers a unique opportunity to diversify one’s investment portfolio. With thousands of cryptocurrencies available, traders can spread their risk across various digital assets, reducing the impact of poor performance in any single asset.

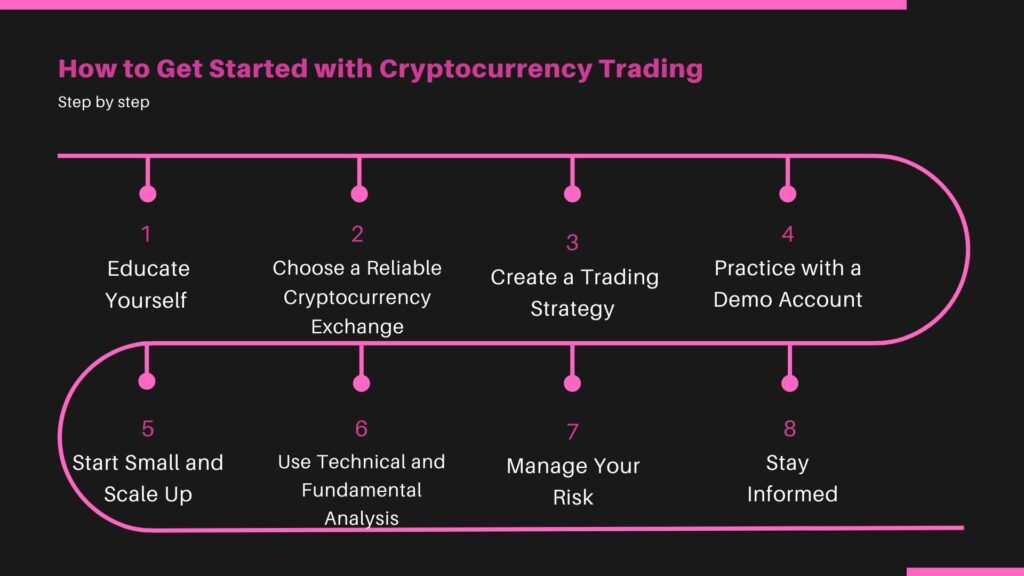

How to Get Started with Cryptocurrency Trading

For beginners looking to dive into cryptocurrency trading, it’s essential to start with a solid foundation of knowledge and a clear strategy. Here’s a step-by-step guide to help you get started:

1. Educate Yourself

Before you start trading, it’s crucial to understand the fundamentals of cryptocurrency, blockchain technology, and the market forces that drive price movements. There are countless online resources, including articles, videos, and courses, that can help you grasp the basics of crypto trading.

2. Choose a Reliable Cryptocurrency Exchange

Selecting a reputable and user-friendly cryptocurrency exchange is one of the most critical steps in your trading journey. Popular exchanges like Binance, Coinbase, and Kraken offer a wide range of cryptocurrencies and trading pairs, as well as robust security features to protect your assets. When choosing an exchange, consider factors such as fees, liquidity, customer support, and the availability of trading tools.

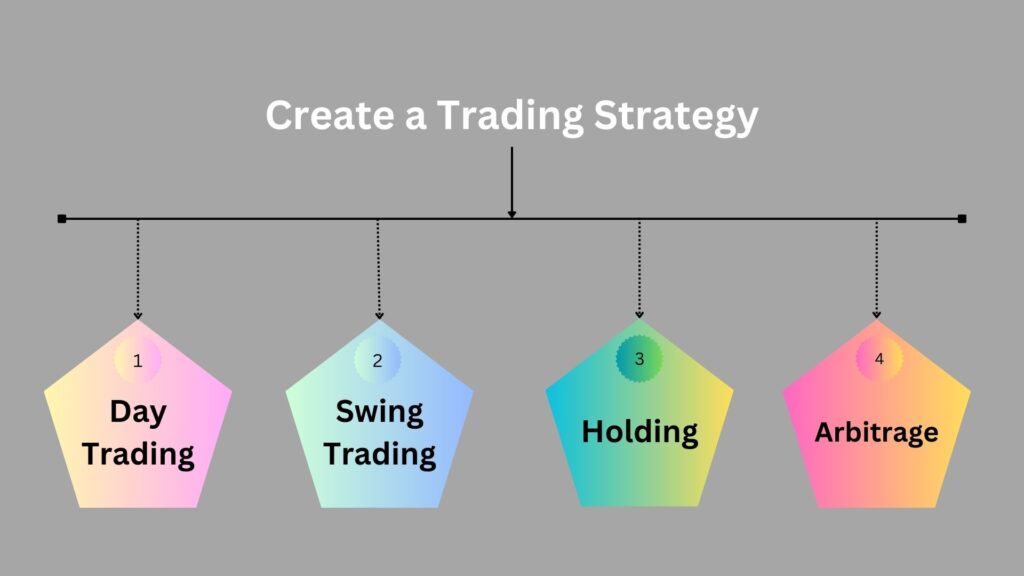

3. Create a Trading Strategy

Successful cryptocurrency trading requires a well-defined strategy. Your strategy should outline your goals, risk tolerance, and the specific trading techniques you plan to use. Some common trading strategies include:

- Day Trading: Involves buying and selling assets within a single day to capitalize on short-term price movements. Day traders rely heavily on technical analysis and chart patterns to make quick decisions.

- Swing Trading: This strategy involves holding assets for several days or weeks to profit from medium-term price trends. Swing traders often combine technical and fundamental analysis to identify potential entry and exit points.

- Holding: A long-term investment strategy where traders buy and hold cryptocurrencies for an extended period, typically months or years, with the expectation that their value will increase over time.

- Arbitrage: Involves taking advantage of price differences between different cryptocurrency exchanges by buying an asset on one platform and selling it on another at a higher price.

4. Practice with a Demo Account

Many cryptocurrency exchanges offer demo accounts that allow you to practice trading with virtual funds. This is an excellent way to familiarize yourself with the platform’s features and test your trading strategy without risking real money.

5. Start Small and Scale Up

When you’re ready to start trading with real money, it’s advisable to begin with a small amount of capital that you can afford to lose. As you gain experience and confidence, you can gradually increase your investment.

6. Use Technical and Fundamental Analysis

To make informed trading decisions, you’ll need to master both technical and fundamental analysis.

- Technical Analysis: Involves analyzing price charts and using various indicators, such as moving averages, relative strength index (RSI), and Bollinger Bands, to predict future price movements. Technical analysis is particularly useful for identifying trends, support and resistance levels, and potential reversals.

- Fundamental Analysis: Focuses on evaluating the underlying factors that affect a cryptocurrency’s value, such as its technology, team, adoption rate, and market sentiment. Fundamental analysis helps traders assess whether a cryptocurrency is undervalued or overvalued, providing insights into long-term investment opportunities.

7. Manage Your Risk

Risk management is a critical aspect of successful cryptocurrency trading. To minimize potential losses, consider implementing the following risk management techniques:

- Set Stop-Loss Orders: A stop-loss order automatically sells your assets when their price falls below a predetermined level, limiting your losses in case of adverse market movements.

- Diversify Your Portfolio: Avoid putting all your capital into a single cryptocurrency. Diversifying across multiple assets can reduce your overall risk and improve your chances of success.

- Use Proper Position Sizing: Determine the appropriate amount of capital to allocate to each trade based on your risk tolerance. A common rule of thumb is to risk no more than 1-2% of your total capital on a single trade.

8. Stay Informed

The cryptocurrency market is highly dynamic, with new developments and trends emerging regularly. To stay ahead of the curve, make it a habit to follow industry news, join online communities, and participate in discussions with fellow traders. Staying informed will help you adapt your trading strategy to changing market conditions.

Common Mistakes to Avoid in Cryptocurrency Trading

As with any form of trading, cryptocurrency trading comes with its own set of challenges and pitfalls. Here are some common mistakes to avoid:

- FOMO (Fear of Missing Out): Many traders fall into the trap of buying into a cryptocurrency simply because its price is skyrocketing, fearing they’ll miss out on potential gains. This impulsive behavior often leads to buying at the peak of a price bubble, resulting in significant losses when the price inevitably corrects.

- Overtrading: Trading too frequently or with too much leverage can quickly deplete your capital. It’s essential to be patient and wait for high-probability trading opportunities rather than constantly chasing small gains.

- Ignoring Security: Cryptocurrency exchanges and wallets are prime targets for hackers. Always use strong, unique passwords, enable two-factor authentication (2FA), and store your assets in a secure hardware wallet when not actively trading.

- Lack of a Clear Strategy: Trading without a well-defined strategy is a recipe for disaster. It’s crucial to have a plan in place and stick to it, regardless of short-term market fluctuations.

- Emotional Trading: Allowing emotions like greed, fear, or revenge to influence your trading decisions can lead to poor outcomes. Successful traders maintain discipline and adhere to their strategy, even in the face of market volatility.

The Future of Cryptocurrency Trading

As the cryptocurrency market continues to evolve, several trends and developments are likely to shape the future of cryptocurrency trading:

- Increased Institutional Involvement: Institutional investors, such as hedge funds, banks, and pension funds, are increasingly entering the cryptocurrency market. This influx of capital and expertise is expected to bring greater stability and liquidity to the market, as well as attract more retail investors.

- Regulatory Developments: Governments and regulatory bodies worldwide are gradually developing frameworks to govern the cryptocurrency market. While increased regulation may reduce the market’s anonymity and decentralization, it could also provide greater legitimacy and protection for investors.

- DeFi and Decentralized Exchanges: The rise of decentralized finance (DeFi) and decentralized exchanges (DEXs) is transforming the cryptocurrency trading landscape. These platforms allow users to trade directly with each other without the need for a central authority, offering greater privacy, security, and control over assets.

- AI and Automation: Artificial intelligence (AI) and automated trading bots are becoming increasingly popular in the cryptocurrency trading space. These tools can analyze vast amounts of data, identify trading opportunities, and execute trades with minimal human intervention, making trading more efficient and potentially more profitable.

- Integration with Traditional Finance: As the lines between traditional finance and cryptocurrency continue to blur, we can expect to see more integration between the two sectors. This could include the adoption of blockchain technology by traditional financial institutions, the introduction of cryptocurrency-based financial products, and the widespread acceptance of cryptocurrencies as a payment method.

Cryptocurrency trading offers a unique and exciting opportunity to participate in the rapidly evolving world of digital assets. While the market’s volatility and complexity can be daunting, a well-informed and disciplined approach can lead to significant profits. By educating yourself, developing a clear trading strategy, and staying informed about market trends, you can navigate the challenges of cryptocurrency trading and unlock its potential rewards.

Remember, like any form of investment, cryptocurrency trading carries risks, and it’s essential to only invest what you can afford to lose. Whether you’re a seasoned trader or a complete beginner, the key to success lies in continuous learning, patience, and a commitment to improving your trading skills.

OUR BLOGS

Introducing Cryptocurrency and Blockchain

Cryptocurrency Investment

For more information click on VIDEO

2 Comments

Absolute Knowledge about Decentralized Finance (DeFi) and Its Applications, and Key Considerations. - bitbonix.com · October 2, 2024 at 7:58 pm

[…] The Best Guide to Cryptocurrency Trading: Everything You Need to Know […]

Cryptocurrency Mining: A Complete Guide to Understanding, Starting, and Navigating the Environmental Impact - bitbonix.com · December 11, 2024 at 5:05 am

[…] The Best Guide to Cryptocurrency Trading: Everything You Need to Know […]